We ship from multiple warehouses across the country, so you get your part as soon as possible.

Free, one year (or more), unlimited mileage warranty. Covers everything; parts and shipping costs

We have reviewed over 1,000,000 fitments to guarantee an exact fit for your vehicle.

Return for any reason within 60 days for a full refund

Experts in auto parts since 1989-We are rated 4.9/5 by over 400,000 of our customers.

BUY AUTO PARTS IN THE NEWS

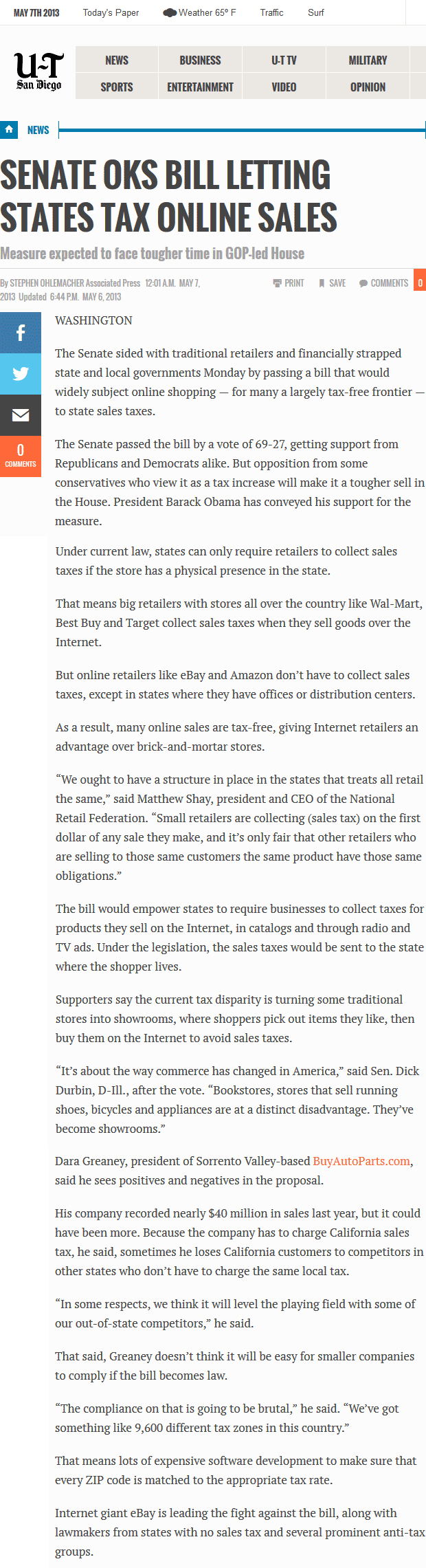

San Diego Union Tribune: Buy Auto Parts' President on Internet Sales Tax

May 6, 2013 - San Diego , CA - Business reporter, Katherine Poythress of the San Diego Union Tribune interviewed Buy Auto Parts’ President, Dara Greaney to discuss what effects The Marketplace Fairness Act will have on online retailers.

What is The Marketplace Fairness Act?

When you currently buy a product online you do not have to worry about sales tax unless the company you are purchasing from has a physical presence in your state, such as a an actual brick and motor store or a warehouse. This is why a majority of online sales are tax-free.

However, The Senate passed the Marketplace Fairness Act late last night. This bill will affect everyone in the country whom sells or purchases any type of product on the internet. Tax-free online purchases will be no more. Every online transaction will be taxed, whether the company has a store in the same state or not.

Supporters of the Maketplace Fairness Act say this bill levels the playing field and allows stores to have a fighting chance against online retailers selling with an unfair advantage. Opponents of the bill say that the processing of the taxes will be a logistics nightmare, and although it may help out local mom and pop brick and motor stores it will crush the mom and pop online stores. They don’t have the resources to comply with all of the different tax codes.

The bill still has to make it through The House, and this will likely be a tough uphill battle. So, all of this debate over the Act is likely going to be mute.